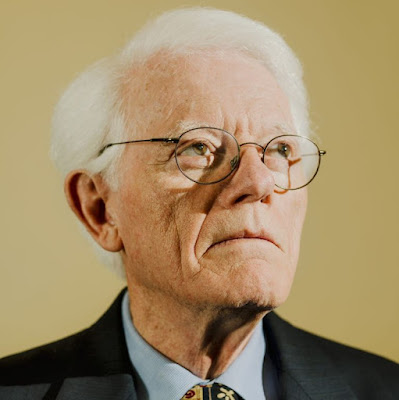

圖片取自網路

我知道 Peter Lynch 是位傳奇的基金經理人,但我沒想到,他在 Worth Magazine 上面的文章,也會有多位 Blogger 推薦要看。

最意想不到的是,除了國內的投資達人,連老外也很推崇他,還特地在 Blog 上放上文章連結:Peter Lynch Articles for Worth Magazine。

Use Your Edge

所以我又重新看了一遍 Use Your Edge 這篇文章。

- Peter Lynch 很強調要運用自己的優勢來選擇股票,同時他相信,只要你能「慧眼識英雄」,那麼少數表現優良的股票就可以讓你賺到很大的回報。

If you put together a portfolio of five to ten of these high achievers, there's a decent chance one of them will turn out to be a 10-, a 20-, or even a 50-bagger, where you can make 10, 20, or 50 times your investment. With your stake divided among a handful of issues, all it takes is a couple of gains of this magnitude in a lifetime to produce superior returns.

- 他不贊成現在很多投資專家提倡的「再平衡」這個策略,也就是強調要「讓獲利奔跑」。

One of the oldest sayings on Wall Street is "Let your winners run, and cut your losers." It's easy to make a mistake and do the opposite, pulling out the flowers and watering the weeds.

If you find one great growth company and own it long enough to let the profits run, the gains should more than offset mediocre results from other stocks in your portfolio.

- Peter Lynch 認為投資人容易犯的錯誤是,一直在等待股票便宜的時候購買,以及低估了一家成長型公司可以隨時代進步、成長的時間(我的翻譯功夫不是很到位⋯⋯哈!)。

- 關於第一點,我認為他不是說不需要注意安全邊際,而是即使一檔股票的本益比很高,但也許那是它的內在價值就值得那麼高的本益比;而第二點,則是說明一家優秀的成長型公司,可以在市場上存活很久,接受市場的考驗及磨鍊。

There are two ways investors can fake themselves out of the big returns that come from great growth companies.

The first is waiting to buy the stock when it looks cheap.

The second mistake is underestimating how long a great growth company can keep up the pace.

- Peter Lynch 在這篇文章後面的篇幅中,說明他會給投資人什麼樣的建議。

- 我個人覺得最受用的是這一點:要有耐心。他自己都承認,有些股票花了10 年的時間才讓他獲得巨大的回報,而這其實就是強調並彰顯長期投資的重要性。

Be patient. The stocks that have been most rewarding to me have made their greatest gains in the third or fourth year I owned them. A few took ten years.

沒有留言:

張貼留言